- #Make a fake bank statement online how to#

- #Make a fake bank statement online verification#

- #Make a fake bank statement online series#

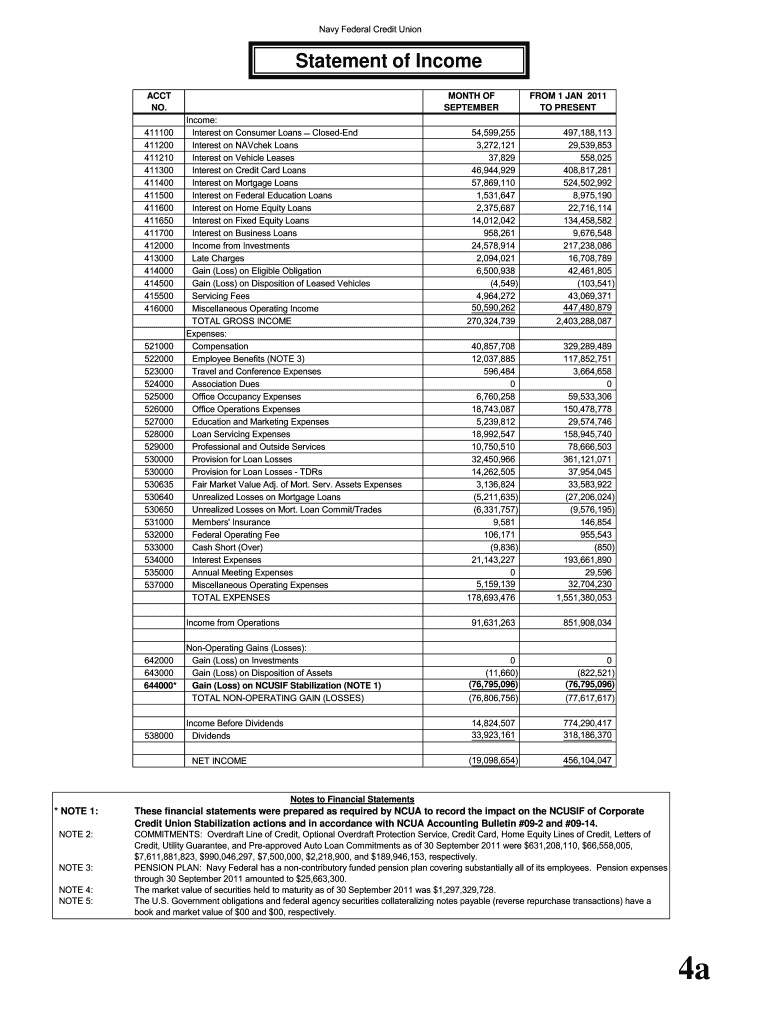

The proof of deposit is the only way for a mortgage lender to verify if any sort of transaction has taken place before applying for the mortgage. The lender then is asked to verify that the funds required for home purchase have been transferred in a bank account and are now can be accessed by the borrower. These criteria can include current income, assets, savings, and borrower’s creditworthiness.ĭuring the process of applying for a mortgage for property purchase, the lender can and will ask the borrower for proof of deposit on the property.

#Make a fake bank statement online series#

To approve a mortgage application, a mortgage lender needs to verify a series of details.

#Make a fake bank statement online how to#

Understanding How to Verify Bank Statements? To save themselves such cases of financial fraud, mortgage leaders need to find ways to check and verify bank statements. In recent years, there have been multiple instances where mortgage lenders have been scammed out of their money with fake bank statements. Keeping this in mind, mortgage lenders are legally obligated to identify and authenticate bank statements. With thousands of sophisticated technologies out there, it doesn’t take more than minutes to forge bank statements and other documents.

#Make a fake bank statement online verification#

During the loan approval process, if you’ve ever wondered “why is verification of bank statements for mortgages required?” then the answer is to reduce the chances of people with fake documents acquiring funds for illegal activities. A proof of deposit may also require the borrower to provide a minimum of 2 consecutive months bank statements. One of the major factors involved in loan approval is the verification of the borrower’s financial information, but how do mortgage lenders verify bank statements for loan approval.īanks and other financial institutions may demand a “proof of verification deposit” form to be filled in and sent to the borrower’s bank for process completion. If you seek a mortgage for buying a new home or for refurbishing, it has to be approved by a mortgage lender for you to get your loan.

How Do Mortgage Lenders Check & Verify Bank Statements? RoosterMoney isn’t a bank, but you can still get digital statements via our app. In the past, most bank statements were printed on paper, but today more and more banks are offering digital statements, via apps or online. For example, BSP can mean ‘Branch Single Payment’, or a payment made into an account in person, at a bank branch, while TFR can mean a transfer of money between accounts. Some include bank statement codes beside these entries, to help you remember what each payment was for. A savings account might show just a few interest payments going in, while a current or checking account would show lots of small payments out, for everything from shopping to electricity bills, as well as a few payments in, such as a regular salary. There’s also a running total of how much money is left this is called a balance.ĭifferent accounts have different looking statements. Payments in might be shown in one column, and the payments out in another. It covers a given period, such as a month the bank sends statements out regularly to its customers. A bank statement is an official list of everything paid into and out of a bank account.

0 kommentar(er)

0 kommentar(er)